The Silent Revolution of Biometric Payments

Imagine walking into a store, picking up what you need, and walking out—no cash, no cards, no phones. Instead, your fingerprint, face, or even your iris serves as your payment method. This is the world of biometric payments, and it's becoming a reality faster than you might think.

Biometric payments use unique physical or behavioral characteristics, like fingerprints, facial recognition, or voice patterns, to authenticate transactions. These systems eliminate the need for traditional payment methods, making transactions faster, more secure, and incredibly convenient.

1) Retail Transformation

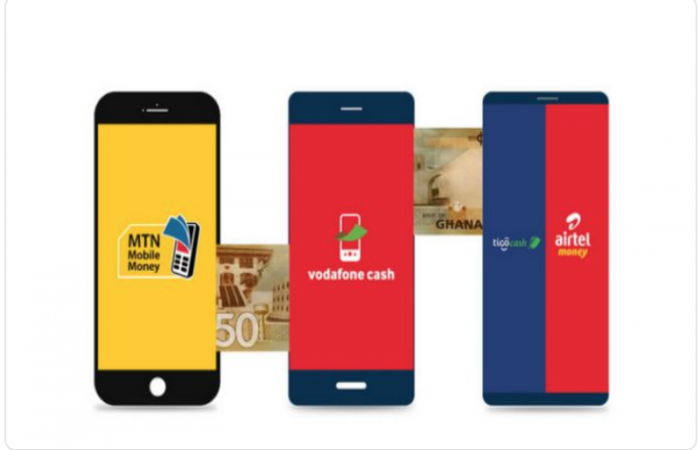

In countries like Ghana, where mobile money has already revolutionized payments, biometric systems are the next big step. Imagine markets and malls where you can pay with a simple fingerprint scan, reducing fraud and eliminating the need for wallets.

2) Banking Simplified

Banks are adopting biometrics for account access and transaction approvals. No more PINs to remember—just a quick face scan or fingerprint is enough.

3) Global Integration

Major companies like Amazon are experimenting with palm recognition for seamless checkout experiences, while Mastercard is piloting biometric payment cards in emerging markets.

1) Enhanced Security: Unlike PINs or passwords, biometric data is nearly impossible to replicate, drastically reducing fraud.

2) Convenience: No need for devices or cards—just you and your biometrics.

3) Speed: Transactions are completed in seconds, making them perfect for busy settings like transport hubs and retail stores.

While the technology is promising, it raises critical questions about data privacy and security:

Data Storage Risks: If biometric data is hacked, it’s irreplaceable, unlike a password or card.

Privacy Concerns: Who controls the data, and how is it being used?

Governments and tech companies must work together to establish robust security and regulatory frameworks.

Biometric payments represent the next evolution in how we interact with money. As adoption grows, they will redefine convenience, security, and how we view financial transactions.

By 2025, the idea of forgetting your wallet or phone might seem quaint—after all, you’ll always have your fingerprints or face with you. Would you trust your body as your new wallet?